Invoice processing is a business function performed by the Accounts Payable (AP) division of the Financial Accounting department. The process involves the following of a series of steps, starting from receipt and right until payment settlement, to manage supplier or vendor invoices effectively. These tasks are typically performed manually using a general ledger.

However, as with every manual business process, invoice processing comes with its fair share of drawbacks and limitations. On that note, let’s take a look at how invoice automation can add value to businesses and drive better results.

What are the Steps Involved in Standard Invoice Processing?

To understand how automated invoicing works, one needs to first understand the standard invoicing process. It includes the following steps:

- Upon the delivery of the goods or service, you will receive an invoice from the supplier or vendor.

- A copy of this invoice is scanned or placed in the filing system. The details of the invoice are recorded onto the general ledger.

- The details of the invoice are corroborated and the invoice is approved after thorough vetting.

- Finally, the authorized personnel approves the payment of the invoice and the bill is settled.

- Finally, the authorized personnel approves the payment of the invoice and the bill is settled.

Standard Invoice Processing

What is Automated Invoice Processing?

As the name suggests, Automated Invoice Processing automates the invoicing process completely or partially. It is an electronic process that extracts key data from all the incoming invoices and pushes it into the ERP or AP systems to facilitate faster payments.

How Does Automated Invoicing Work?

Automated invoicing helps tame the chaos of handling and managing invoices in the following manner:

- The scanned invoice or the invoice attached to the email is analyzed. The invoice automation tool powered by its OCR capabilities extracts data from the digital file.

- The extracted data is validated against the business rules listed in the master vendor file.

- The invoice, which is currently marked as “Under Review,” moves to the “Verified” state after all the extracted information passes the 3-way validation rules that match the information of the invoice received, the purchase orders, and the receipts for each invoice. In the case of discrepancies, the case will be escalated for a manual review.

- A report containing all the invoice data is generated and undergoes general ledger coding, after which it is exported into the AP or ERP system for approval and settlement.

- The processed invoices are finally archived for later reference, audits, or maintaining payment history.

Advantages of Automated Invoice Processing

Invoice automation offers a host of benefits that may be summarized as follows:

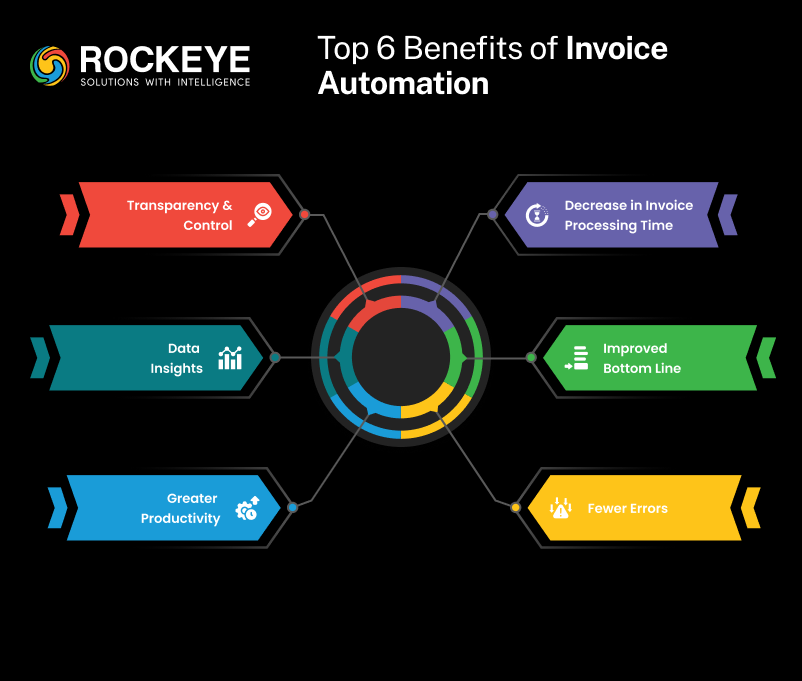

Decrease in Invoice Processing Time

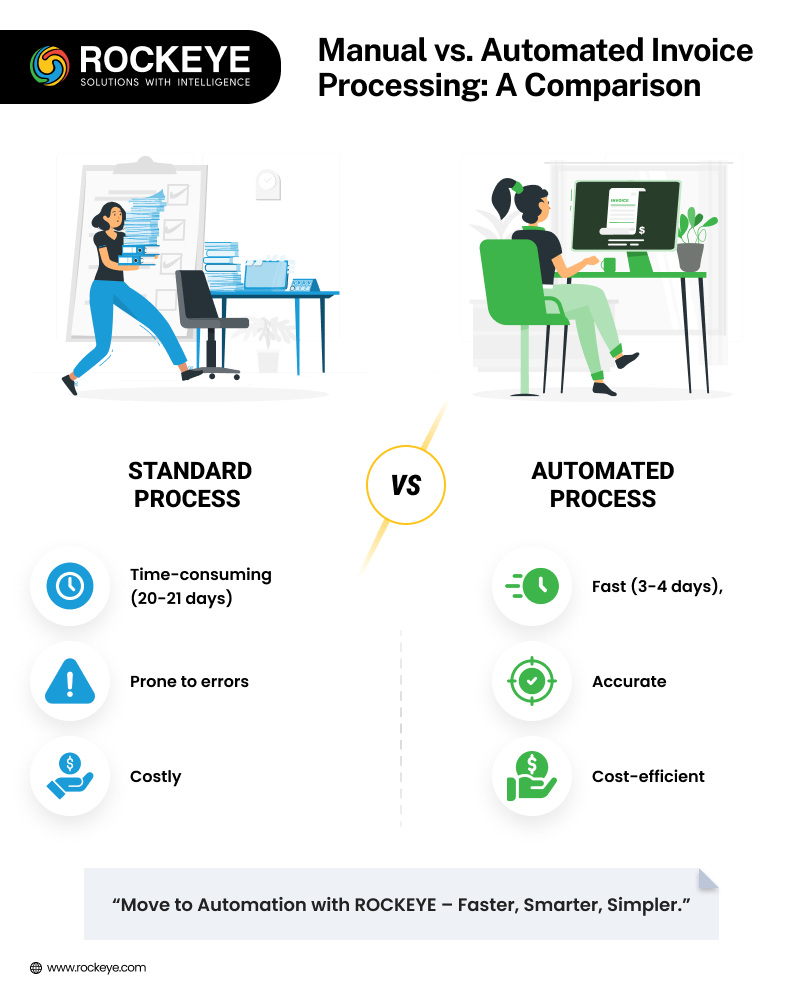

At the outset, saving on a precious resource such as time is one of the key benefits of automating the invoicing process. To put these savings into perspective, manual invoice processing takes anywhere between 20 to 21 days. However, add automation in the mix and you can cut down this timeline to 3 to 4 days, which is impressive!

An Uplift in the Bottom Line

When you know that time is money, the above savings can already be quantified into their monetary counterparts. The timely processing of invoices decreases the penalties and interests, if any, that your business may otherwise attract for delayed payments. Plus, it also bypasses the costs involved in printing invoices and maintaining physical records.

Reduction in Invoice Processing Errors

Automated systems are less likely to make errors than their human equivalents. Even the slightest of mistakes can avalanche and have costly ramifications. Given that most errors can creep in during the data entry or processing stages, automation can mitigate its effects and save the business from landing in hot waters. It also reduces the back and forth that may arise out of inaccuracies and reduce the number of checks that the company will have to issue or reissue.

Greater Employee Productivity

By offering an invoice automation tool, you are empowering your employees to achieve more than they can. These tools will complement their abilities and reduce the time spent per invoice. Plus, it will also strike the speed and accuracy balance, which frees up precious human resources for more pressing matters at hand.

Fewer Hiring and Dependencies

In addition to greater employee productivity, invoice automation leaves room for companies to downsize their AP staff without worrying about their performance or impacting their capabilities. With smarter and more efficient members on the team, the pressure for making immediate hiring reduces and so does the dependency involved. As a result, companies can scale up at their own pace and make well-rounded hiring decisions.

Better Insights Through Data

As we transition towards a data-driven economy, sticking to obsolete or legacy systems will only pose more problems than solutions. Automation shifts your entire invoicing process into the digital playfield, which allows businesses to collect more data and gain better insights through it. Businesses can harness invoice data in the long run to monitor transactions and flag fraudulent activities. Similarly, the historical data can help filter out questionable suppliers and vendors as well as offer discounts and other benefits to high-value vendors.

Increased Transparency and Control

Since the implementation of an invoice automation platform, tracking invoices and their status in real-time has never been easier. Such a feature imparts greater transparency and ascribes accountability at every level. At the same time, most invoice automation platforms seek explicit approvals from the authorized personnel while initiating critical processes, such as invoice payments, which offers greater control to the organization without having to dabble in the number-crunching game.

Increased transparency and control

Conclusion

With the above information, you may have a deeper understanding of the role of automation in the invoicing process.

The key takeaway is that invoice automation pushes for a data-centric approach while handling AP, which can go a long way in stimulating the business’ growth. It plugs in any leakages and takes care of bottlenecks that may be coming in the way of timely invoice processing. Plus, it transforms your business into a growing organism that is responsive to the business’ needs and can subsume future solutions. Depending on your requirements, companies can augment processes with technologies like machine learning, predictive modeling, etc., and integrate them seamlessly. One can even consider going mobile, which may have been unheard of until recently!

All in all, invoice automation can draw long-term benefits such as greater resilience, more cost savings, and higher working capital that can be reinvested in the business to fuel accelerated growth.

FAQs

Q1: What is invoice processing?

Invoice processing is a function performed by the Accounts Payable (AP) division within the Accounting department. It starts right from the receipt of the supplier or vendor invoices and continues until the payment is settled. Traditionally, this process is managed manually using a general ledger.

Q2: What are the steps involved in standard invoice processing?

The standard invoice processing workflow includes:

- Receiving an invoice from the supplier or vendor after the delivery of goods or services.

- Scanning or placing the invoice in a filing system and recording its details into the general ledger.

- Corroborating the invoice details and approving the invoice following thorough vetting.

- Obtaining approval from authorized personnel and settling the bill.

Q3: What is automated invoice processing?

Automated Invoice Processing automates the invoicing workflow completely or partially. It is an electronic process that extracts key data from incoming invoices and pushes it into the ERP or AP systems, speeding up payments and reducing manual intervention.

Q4: How does automated invoicing work?

The automated invoicing process involves:

- Analyzing the scanned invoice or the invoice attached to the email.

- Leveraging OCR capabilities to extract key data from the digital file.

- Validating the extracted data against the business rules in the master vendor file.

- Marking the invoice as “Verified” after it passes 3-way validation (matching the invoice details with purchase orders and receipts). Discrepancies trigger manual reviews.

- Generating a report of the invoice data, coding it for the general ledger, and exporting it into the AP or ERP system for approval and settlement.

- Archiving the processed invoices for reference, audits, or maintaining payment history.

Q5: How can automated invoice processing save time?

By cutting down the invoice processing timeline from about 20-21 days to as few as 3-4 days, automation saves a significant amount of time and accelerates payment cycles.

Q6: What financial advantages can automated invoicing offer?

Automation reduces the penalties, interests, and other costs associated with delayed payments. It also minimizes expenses related to printing invoices and maintaining physical records, thus offering a measurable uplift in the bottom line.

- 3-way validation

- accounts payable

- accounts payable automation

- AP department

- AP staff efficiency

- AP systems

- automated invoice processing

- automation benefits

- business automation

- data-driven invoicing

- employee productivity

- ERP systems

- financial accounting

- financial growth

- invoice approval

- invoice automation

- invoice control

- invoice data insights

- invoice processing

- invoice processing errors

- invoice processing steps

- invoice settlement

- invoice transparency

- invoice workflow

- OCR capabilities

- payment cycles

- predictive modeling

- Supplier management

- vendor invoices