Electronic procurement, or e-procurement is a digital process which is used to buy and sell goods and services. E-procurement integration with financial accounting can ensure seamless flow of data from both departments. Purchase orders, payments and invoices can therefore be automatically generated and tracked. Chances of errors in manual entry are minimized as a result.

As per research by Gartner , a well-known research and advisory firm, 83% of businesses are recognizing the major role of supply chain in improving customer experience and are prioritizing customer experience while creating digital business strategies. This shift signifies that supply chains are not only logistical operations but are integral in delivering smooth, customer-centric experiences.

The GEODIS Supply Chain Worldwide Survey revealed that just 6% of 623 companies surveyed claimed that they have achieved full supply chain visibility, though this was the third most significant priority in 2017. The low visibility is a matter of concern, because of the increasing demand for product availability and corporate transparency from the customers.

31 Steps for Integrating E-procurement with Your Company’s Financial Accounting Process

Step 1: Automated Approval Workflows

- You can implement automatic workflows to enhance the speed of the procurement process and simultaneously the existing internal policies and regulations.

- By defining these rules, your firm will be able to route purchase requests to the right stakeholders for their approval. Delays will therefore be considerably reduced.

Step 2: Compliance and Audit Trail

- Implementing e-procurement integration ensures logging and recording of each activity in the accounting system, ensuring the robustness of the audit trail.

- This strategy improves internal policies as well as regulatory standards, ensuring transparency and accountability within a company.

Source: Nanonets

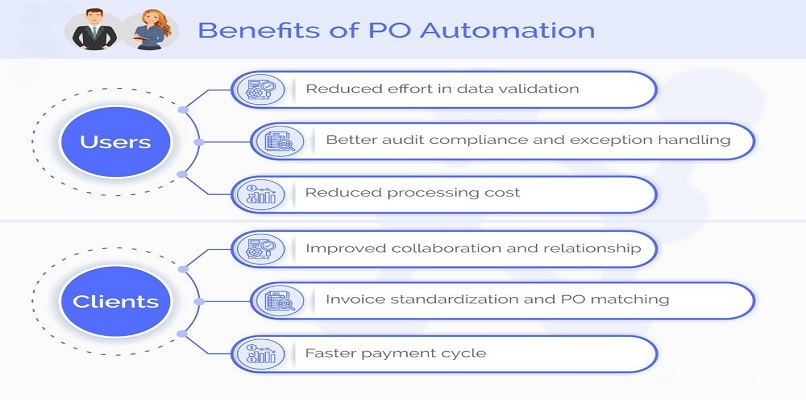

Step 3: Automated Purchase Order (PO) Generation

- After a purchase request gets initiated from the e-procurement, it must generate a purchase order automatically.

- This PO includes vital information like price, quantity, item description, and vendor details. The integration also makes sure that the information is in sync with the financial accounting system.

Step 4: Automation of Workflow

- E-procurement integration helps to ensure workflow by removing the manual data entry and approval processes. You can automate payment, approvals, and purchase requisitions based on predefined workflows. It will enhance efficiency and reduce processing time as well as the risk of errors.

Want to integrate your e-procurement and financial accounting processes? Rely on ROCKEYE for the finest ERP Solutions, ensuring seamless integration with Advanced Procurement Software Solutions for your business needs.

Step 5: Cost Savings Analysis

- This system offers tools for analyzing procurement costs and also to identify opportunities for saving costs. You can detect areas of overspending and inefficiency by comparing actual spending against the allocated budget amount.

- Cost-saving initiatives, such as volume discounts can be assessed based on their impact on your organization’s financial performance.

Step 6: Payment Processing

- After the invoices get approved, the system will automate payment generation based on predefined terms and methods of payment.

- Payment details are recorded in the accounting system, and accounts payable and bank reconciliation records are updated. Integration with electronic payment systems will enable you to make secure fund transfers to vendors.

Step 7: Compliance Monitoring

- E-procurement integration with accounting helps to ensure real-time monitoring of procurement of activities for compliance with internal policies and external regulations.

- Unauthorized purchases, possible policy violations and configured alerts and notifications are flagged via configured alerts and notifications.

- Compliance reports generate internal audits and regulatory assessments, improving overall governance and risk management.

Step 8: Forecasting and Planning

- By analyzing historical procurement data which is stored in the accounting system, you can perform trend analysis and forecasting. Integration helps to extract relevant data for planning budgets, forecasting demand, and strategic decision-making related to procurement.

- This approach helps to optimize purchase strategy, negotiate better pricing, and also manage risks related to the supply chain.

- The integration of both systems improves forecast accuracy and capabilities related to demand planning. By analyzing financial trends and historical procurement data, you can predict the future demand for goods and services of your company accurately.

- This ensures better inventory management, minimized stockouts, and enhanced customer service quality. Integration also supports lean procurement practices and just-in-time (JIT) inventory strategies.

Step 9: Supplier Relationship Management

- E-procurement integration with SRM modules helps to improve supplier collaboration and performance monitoring. Companies can track supplier performance metrics, such as delivery time, quality of services/goods, and adherence to the terms mentioned in the contract.

- This data helps to make an informed selection of suppliers, renegotiation of contracts, and continuous initiatives for improvement.

Step 10: Mobile Accessibility

- The system will provide you access to procurement data. You will be able to perform these tasks from your mobile. Mobile applications or web interfaces offer on-the-go access to purchase requisitions, approvals as well as status updates.

- This will improve user convenience, speed up the decision-making process, and improve responsiveness to procurement-related needs, especially for remote or field-based personnel.

Step 11: Global Procurement and Multi – Currency Support

- For companies that operate across the globe, or deal with international vendors, integration offers support for transactions across different currencies. The system can handle conversions of different currencies, and exchange rate fluctuations and ensure compliance with existing foreign exchange regulations.

- Multi-currency reporting capabilities ensure the generation of consolidated financial documents and analysis across various geographical regions.

Step 12: Dynamic Pricing and Contract Management

Unifying both these domains enables companies to leverage dynamic pricing models and manage contracts. This system can track negotiated price agreements, discounts as well as rebates with vendors.

It also ensures contract lifecycle management, including the creation of contracts, approval, renewal, and termination. Integration also ensures that pricing terms are accurately shown in invoices and financial records.

Step 13: Continuous Improvement and Feedback Loop

The amalgamation of both systems supports a continuous mindset of improvement by enabling feedback loops and also performance monitoring.

As a user, you can offer feedback on procurement processes, vendor performance, and product or service quality within the e-procurement system.

Integration with financial accounting systems captures the feedback and adds it to the performance metrics and process optimization-related initiatives. Continuous improvement drives ensure better efficiency, cost reductions, and higher stakeholder satisfaction over a period.

Step 14: Centralized Vendor Performance Evaluation

E-procurement integration enables centralized vendor performance evaluation and benchmarking to be done. You can set key performance indicators (KPIs) for vendors and track their performance over a period.

E-procurement integration with financial accounting systems enables the calculation of vendor scoreboards, and rating suppliers on aspects such as quality, delivery, and responsiveness.

Adopting such a data-driven approach helps in supplier selection, renegotiation of the contract, and vendor relationship management.

Step 15: Interdepartmental Collaboration and Data Sharing

- Integration enables collaboration across all departments of an organization by ensuring hassle-free data sharing and communication.

- Procurement data can be shared with different departments like operations, logistics and finance. This improves coordination, and enables a company to make informed decisions.

Step 16: Asset Management and Depreciation

- Unification of e-procurement and accounting enables seamless tracking of assets that are procured via an e-procurement system. After the assets have been acquired, their details will be recorded automatically in the accounting system.

- Integration helps to calculate asset depreciation over time. So, the financial reports generated have a high degree of accuracy.

Step 17: User Training and Support

- User training and support programs to ensure the adoption and usage of integrated systems. These training sessions make users familiar with e-procurement workflows, financial accounting processes as well and integration features.

- User support resources like user forums, help documentation and FAQs can offer ample assistance. Ongoing education and skill development helps users to make good use of integrated systems and boosts productivity.

Step 18: Integration with Business Intelligence (BI) and Analytics

- Unification with BI and analytics platforms will help you acquire strategic insights on procurement data. This will help in the decision making process. Using this data along with that of financial accounting, you will be able to track the latest trends, patterns, and opportunities to minimize costs and optimize the process.

- Integrating both with BI tools will help you develop customized dashboards and generate interactive reports along with predictive analytics models.

Step 19: Inventory Management and Asset Tracking

Many systems are equipped with features for asset tracking and inventory management. By integrating this data with financial accounting, you can maintain accurate records related to inventory and asset acquisitions, helping your organization to optimize inventory and manage assets with high efficiency.

Step 20: Centralized Procurement Platform

- This process involves the use of a centralized platform for management of all procurement-related activities. It needs to be integrated seamlessly with financial accounting systems to ensure that all transactions are done seamlessly.

Step 21: Automated Purchase Requisitions

- E-procurement systems enable users to create purchase requisitions electronically. These are then automatically routed for approval. Integration with financial accounting makes sure that all approved requisitions are recorded precisely.

Step 22: Scalability and Flexibility

- To accommodate the changing needs of a company, these systems need to be highly scalable. They need to adapt to changing business needs and support different procurement processes across various departments and locations.

Step 23: Cost Allocation and Expense Tracking

- These systems ensure accurate cost allocation. This is done by assigning expenses to the appropriate projects. It helps companies to track spending patterns and analyze procurement-related costs for better planning of finance.

Step 24: Data Analytics and Reporting

- The combination of data from both these sources can be used for advanced analytics and reporting. Companies can acquire valuable insights on spending patterns, performance of suppliers, and cost-saving opportunities to make wise decisions.

Step 25: Real-Time Budget Monitoring

- Merging data of both domains ensures real-time monitoring of the allocated budget. Doing so ensures that procurement activities stay within the planned budget.

Step 26: Forecasting and Demand Planning

- Merging e-procurement and financial accounting can help you to enhance the forecasting and demand planning process of your firm.

- Analyzing financial performance metrics using procurement data will enable you to predict purchasing needs of the future. Thus, it will be easier for you to optimize inventory levels.

Step 27: Budget Integration

- Unifying data of both these domains helps to ensure better budget integration. You can verify the purchase requests and orders against available budgets in real-time.

- This will ensure that expenses are within the budget approved by the management. Doing this enables companies to manage costs and make sure that there is no overspending.

Step 28: Cost Savings and Efficiency

- Automating and integrating both procurement and financial accounting processes can ensure ample cost-savings and enhance the efficiency of your company. Paperwork will be minimized and cycle times will be faster.

- Quicker decision-making and supplier management will improve your firm’s operational efficiency and minimize overall costs.

Step 29: Streamlined Procurement Processes

- Integrated e-procurement enables companies to streamline their procurement process by automating different tasks such as vendor management, purchase order creation, requisitioning and invoice processing.

- Streamlining helps to reduce manual effort, errors and also improve the speed of the procurement cycle.

Step 30: Real-Time Visibility

Merging offers real-time visibility into both these processes. This visibility allows stakeholders to track orders, check spending, and also analyze procurement data with higher efficiency. It also ensures better decision-making and budget control.

Step 31: Supplier Performance Evaluation

- Integrated systems help companies evaluate supplier performance based on different metrics like timeliness of delivery, product quality, and pricing.

- The data can also be integrated with financial accounting to check the overall impact of supplier relationships.

- Incorporating all the above points will make e-procurement integration possible with financial accounting systems and address different aspects of procurement management, financial control, and strategic planning within your company. Doing so helps companies to optimize their procurement operations and improve their financial performance.

How RockEye Can Help To E-Procurement Integration?

At ROCKEYE, we offer streamlined workflows to offer real-time financial insights. Our ERP solutions will help you to enhance revenue flows with efficient management of Accounts Receivable and perfect handling of expenses via Accounts Payable. From budget balances reporting to sales invoice, you will be able to do it all with our ERP solutions.

FAQs

In this blog, we have explained in detail the different benefits of integrating e-procurement with financial accounting. To know more, you can refer to the FAQs given below.

1. Why Is E-procurement Integration with Financial Accounting Important?

Integrating e-procurement with financial accounting helps to streamline the whole procurement process. Data flow from procurement to accounting systems is automated through integration. This improves the transparency, accuracy and efficiency in financial reporting and budget management.

2. What Are The Major Benefits of Integrating E-Procurement with Financial Accounting?

There are numerous benefits of e-procurement integration with financial accounting, such as enhanced spend visibility, reduced manual data entry errors, better compliance with existing financial regulations, quicker invoice processing, and improved cost control.

3. How Does Integration Enhance Spend Visibility?

Linking e-procurement with financial accounting can help organizations to gain valuable insights on their spending patterns. This visibility helps them to identify cost-saving opportunities, negotiate better contracts with suppliers and also optimize procurement strategies.

4. Does Integration Minimize Manual Data Entry Errors?

Yes, integrating procurement with financial accounting minimizes manual data entry errors by eliminating the necessity for duplicated data entry across multiple systems. Automated data synchronization ensures highly accurate and consistent financial records.

5. How does integrated e-procurement help businesses?

Integrated e-procurement improves efficiency by automating procurement workflows, minimizing manual errors, enhancing spend visibility, and helping to ensure better financial planning and budgeting.

Embrace the Future of E-Procurement with Financial Accounting

Empower your businesses with our Smart E-Procurement solutions

Schedule a demo