Over time, many CFOs and finance leaders have inspired executives to set and meet financial goals. They aspire to new levels each year, and the success of a company hinges upon the CFO’s ability to balance risk and reward. You approve budgets to meet company goals and implement policies to minimize waste. One way to get those gears in place is the use of financial accounting platforms.

As manual expense management goes the way of the dodo, you may want to look inward at your current process. It may be time to evaluate whether using an automated expense management platform fits your business goals.

When it comes to CFO responsibilities, their strategies for expense management make the difference between profit and loss. Let’s take a look at those strategies and how expense management platforms can help get you there.

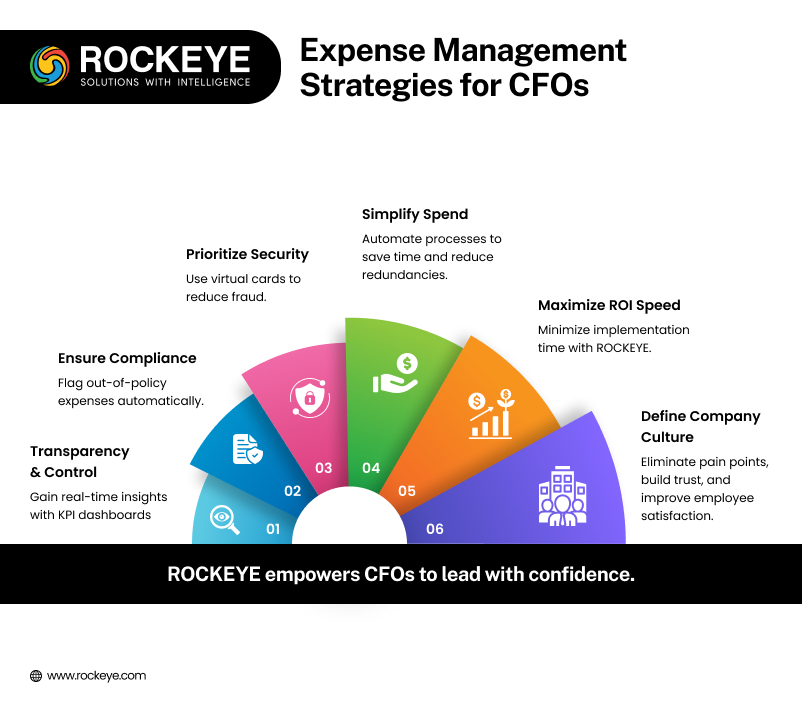

Expense management strategies

- Create an environment of transparency & control

- Ensure compliance

- Prioritize security

- Simplify spend

- Increase speed of ROI

- Establish a defined company culture

Create an environment of transparency & control

CFOs of top financial companies such as Dun & Bradstreet, believed that the three pivotal roles that a Chief Financial Officer must perform include:

- Making the right investment decisions to drive growth

- Turning revenue into strong earnings and cash flow through smart resource utilization and cost reduction and management

- Optimizing capital structure in order to make smart, strategic use of generated cash

Underpinning this all is the need to maintain a rock-solid control environment and to build and develop a top notch, highly energized, and committed team.

Part of developing a controlled environment includes the ability to direct the allocation and approval of funds. Setting up an automated system lets you indicate those in your organization that need access to funds. The best automated expense management platforms allow you to indicate the dollar amount that each tier of leadership can approve without getting an override from a manager above them. It also gives managers the ability to directly monitor the spending trends of their employees through generating reports or at-a-glance KPI dashboards.

With greater transparency into daily, monthly, and yearly spend, you can begin to manage spend proactively, rather than reactively. We call this Proactive Expense Management (PEM) or Spend Management. PEM translates into greater control over every aspect of expense reporting, from approving expenses on the go to raising and lowering limits according to your business’s needs. No more waiting for the end of the month or the end of the quarter to course correct.

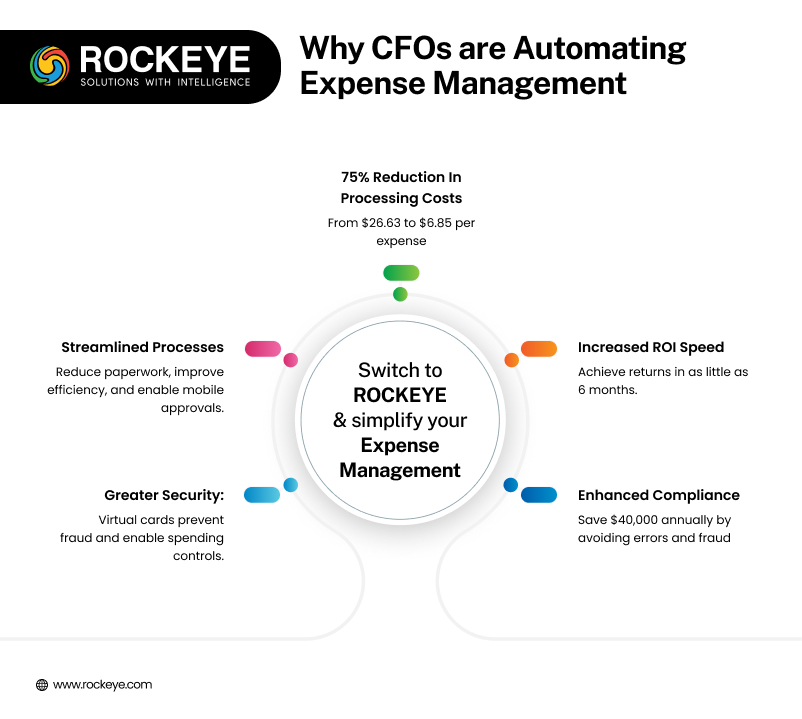

Ensure compliance

You can ensure compliance with company policies by automatically disapproving or flagging out-of-policy purchases that require a special override. Compared to manually auditing expense reports, the average enterprise sees a savings of $500,000 to $1.5 million annually without error and fraud sapping valuable resources.

Enterprises can save between $500,000 to $1.5 million annually through cost optimizations:

Cloud Computing Savings: A 5% optimization in cloud expenditures on the same budget can save $500,000 annually.

Operational Cost Savings: A 15% reduction in a $10 million operational budget can save $1.5 million per year.

Since you can easily monitor the spend of every individual, department, and business as a whole, it’s simple to see areas of overspend and course correct before overspending turns into a blown budget. You can receive notifications when individuals or departments get within a certain percentage of reaching budget capacity and either allocate more funds, or temporarily freeze spend if necessary.

Travel

One of the most frequent violators of compliance is business travel. There are so many expense elements to planning and executing corporate travel, so it’s critical that your compliance includes explicit travel policy. Far too often your budgets are at the mercy of receipts turned in after return, and you open yourself up to travel & expense fraud. Instead, using expense management software can allow CFOs to create policies around travel expenses, outline budgets before each trip, and carefully monitor travel costs as they are occurring.

Prioritize security

A disciplined expense management policy is only as good as the employees who uphold it. With an automated system, the policy gets worked right into the approval process, greatly reducing the possibility for fraud and abuse. It also recognizes and limits overspending, whether intentional or unintentional, by flagging large purchases or approvals that push you over budget. With automated checks and balances in place, the financing team will not need to spend painstaking hours making sure every report follows protocol and has the correct approvals in place.

Simplify spend

Do you know how many man hours are spent in your organization on spending, expense reports, supply chain communications, reimbursements, and accounting? Sometimes it’s not the actual spend that needs to be curbed for improved business performance—just the processes around it. An important responsibility of your finance team should be to look for cost reduction solutions. Here’s some examples of how companies can simplify spend and save money through automating expense reports:

- Improved efficiency in expense reporting process

- Reduction in processing costs (less paper, postage, storage, etc.)

- Mobile accessibility

- Increased employee productivity

- Control over subscriptions (marketing platforms, website hosting, software tools, etc.)

- Elimination of payment for duplicate expenses/reports

- Travel expense management (pre-trip authorization, airline exclusive deals, etc.)

- Reduction in fraudulent expenses

- More accurate mileage tracking

With the right expense management solution, the benefits of the investment manifest not only in eliminating redundancies, overspend, and errors for controlling costs, but in saved time. With the automated system, employees can divert the hours per week that they previously spent filing and re-filing expense reports to their core job description. The efficiency and simplicity of the system yields greater returns in the short and long term.

Also Read: Accounts Payable Automation: Scale Business Efficiently

Increase speed of ROI

Some expense management solutions have hidden costs, not to mention a very involved implementation and training period that slows the initial adoption of the program, causing disruption in the day-to-day operation for employees. Depending on the size of your organization, the initial cost of a new expense management platform, coupled with monthly, per-user subscription fees could add up to a pretty penny. Most companies advertise their system costing anywhere from $26-$8 per person, per month, not accounting for the supplemental costs of implementation, training, technical support, and additional admins. The higher the cost at the outset, the longer it takes to achieve ROI.

With subscription-based expense management models, companies report a return on investment ranging anywhere from 6 months to 36 months. After incurring the initial starting costs listed above, return takes more time based on the size of the business, the number of users and admins, the amount of reports generated, and the amount of support needed in case of technical difficulties, etc.

Establish a defined company culture

Automating spend removes many common pain points and allows people to improve efficiency on a day to day basis. Some common pain points include employees losing paper receipts, failure to submit reports on time, the time it takes to reconcile, review, and approve reports, policy violations, errors, and the time it takes to reimburse employees for out-of-pocket expenses.

Eliminating these pain points removes a large amount of stress from all parties involved in the expense process. The simplicity of automating expenses, trusting employees with their own company cards and spend, and the faster reimbursement time improves the quality of life for employees. Quick and easy approvals, with greater visibility into spend paired with mobile access translates into happier managers. Less red tape, more control, and better security along with reduced (or non-existent) on-boarding cost, and more efficient use of company assets equates to happy executives and investors.

Today’s CFOs and finance executives beyond the CFO role can leverage expense management software into a more trusting, open, secure, and collaborative company culture. You’ve got the wheel, and it’s time to steer into a more lucrative future.

FAQs

Q1: Why should CFOs consider moving from manual expense management to an automated platform?

A :As manual expense management goes the way of the dodo, you may want to look inward at your current process. It may be time to evaluate whether using an automated expense management platform fits your business goals.

Q2: What are some key strategies for effective expense management that impact a company’s bottom line?

A :When it comes to CFO responsibilities, their strategies for expense management make the difference between profit and loss. Let’s take a look at those strategies and how expense management platforms can help get you there.

Expense management strategies

- Create an environment of transparency & control

- Ensure compliance

- Prioritize security

- Simplify spend

- Increase speed of ROI

- Establish a defined company culture”

Q3: How does creating an environment of transparency and control help CFOs?

A : Part of developing a controlled environment includes the ability to direct the allocation and approval of funds. Setting up an automated system lets you indicate those in your organization that need access to funds. … It also gives managers the ability to directly monitor the spending trends of their employees through generating reports or at-a-glance KPI dashboards.

With greater transparency into daily, monthly, and yearly spend, you can begin to manage spend proactively, rather than reactively. We call this Proactive Expense Management (PEM) or Spend Management. PEM translates into greater control over every aspect of expense reporting, from approving expenses on the go to raising and lowering limits according to your business’s needs.”

Q4: What steps can CFOs take to ensure compliance with company policies?

A :You can ensure compliance with company policies by automatically disapproving or flagging out-of-policy purchases that require a special override. Compared to manually auditing expense reports, the average enterprise sees a savings of $500,000 to $1.5 million annually without error and fraud sapping valuable resources. Since you can easily monitor the spend of every individual, department, and business as a whole, it’s simple to see areas of overspend and course correct before overspending turns into a blown budget.

- accounting software

- automated expense management

- budget management

- business expenses

- business finance

- cash flow management

- CFO guide

- CFO responsibilities

- CFO strategies

- compliance

- corporate budgeting

- corporate finance

- cost control

- cost optimization

- enterprise finance

- expense management

- finance automation

- finance leadership

- financial control

- financial efficiency

- financial planning

- financial reporting

- financial transparency

- ROI

- spend management

- travel expense management