Every business requires the tracking and managing of payables to run its operations efficiently. Whether you provide a product or a service, your company has to deal with multiple partners, suppliers, or buyers who operate through invoices or other similar documents.

Create Invoice Approval Workflow

In such a scenario, it becomes a monumental task to process all invoices manually. The ideal solution is to automate the process and set up a workflow that takes care of invoice processing and approvals without too much manual involvement.

This helps you in streamlining the approval process, building successful relationships with vendors or partners, and maintaining transparency in payment cycles. Invoice Automation also reduces the margin of error or discrepancies in the manual invoicing system.

Nowadays, almost all organizations prefer to have a digitized invoice approval workflow to manage their payables. If you are still stuck with a tedious manual process, the best thing to do is to get acquainted with reviewing and approving invoices automatically and setting up an approval workflow tailored to your needs.

What is an invoice approval workflow?

An invoice approval process includes reviewing and approving invoices from suppliers or vendors before starting the payment process. This takes place after the buyer receives an invoice and is required to pay the stakeholder.

The workflow involves a series of steps that need to be followed in order to clear the invoice and make the payment. You can include all steps into this workflow that ensure there are no overlooks, discrepancies, or errors.

Ideally, the process starts with receiving the invoice. Then, an authorized person from the organization checks the details, approves them, and forwards them to the accounts department for payment processing.

Depending on the size of the company, there might be one or many people involved in this whole process before the invoice is cleared.

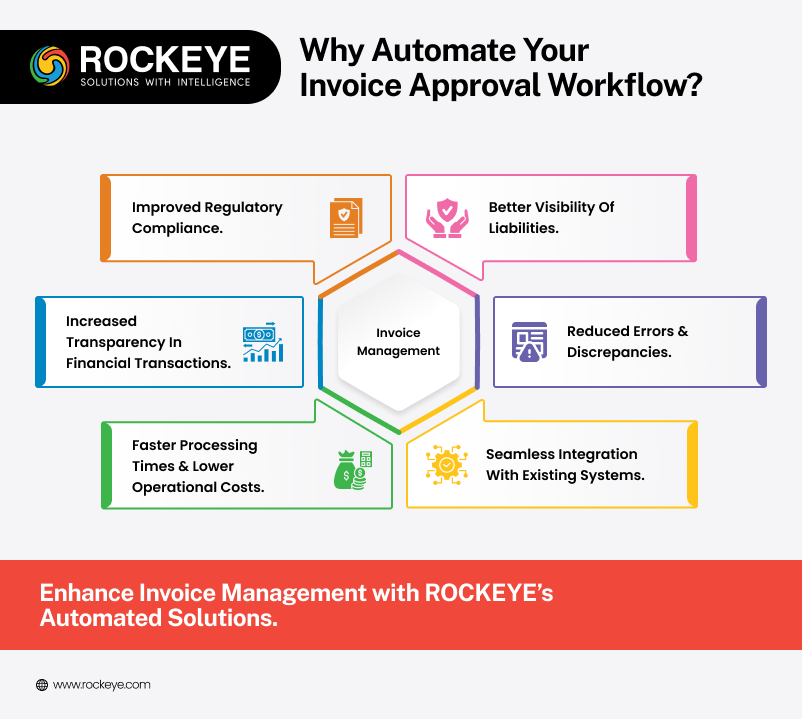

Benefits of automated approval workflow

There are several benefits to having an automated invoice approval workflow. They are:

- Improved regulatory compliance

- More transparency in the process

- Reduced margin of errors and overlooks

- Streamlined process to reduce time and effort

- Increased efficiency and employee productivity

- Integration with existing company systems

- Lower processing costs for each invoice

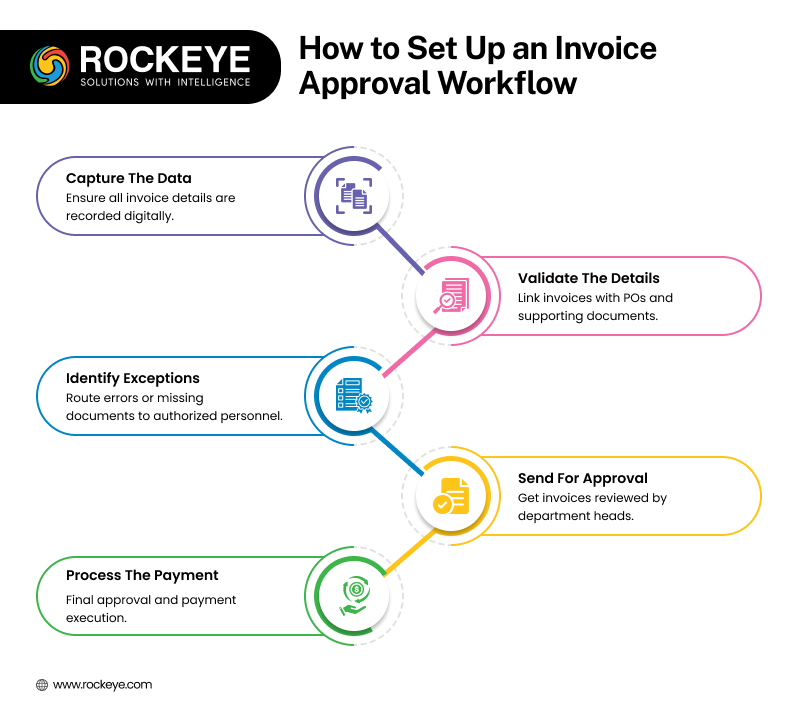

How to Create an Invoice Approval Workflow

For most businesses, there are a few steps to create an approval process for new invoices. Essentially, invoices that come in either have a purchase order (PO) associated with them, or they don’t. Either way, an efficient workflow ensures it is processed correctly and quickly.

Steps to create an invoice approval workflow

Capture the data

Firstly, you have to ensure all invoice details are captured correctly into the approval workflow. This includes details such as products, payable amount, vendor address and bank details, etc.

Validate the details

Once all the details are entered into the workflow, the invoice has to be categorized and associated with all relevant data. This means all its purchasing documents like the PO and order receipt must be identified and linked.

Identify the exceptions

If the invoice fails to show any supporting documents due to a discrepancy, missing PO, or other errors, they should be forwarded to an authorized individual for rechecks and validation.

Send for approval

Once the invoice is validated, it must be sent to the approvers, depending on the PO details, concerned department, or authorized personnel.

Process the payment

Once the approval process is complete, all that is left is to process the payment. For that, the invoice must be forwarded to the finance or accounts department for payment clearance.

All these steps together form the invoice approval workflow. Based on the needs and rules of your organization, you can modify or add steps to this process for the ideal solution.

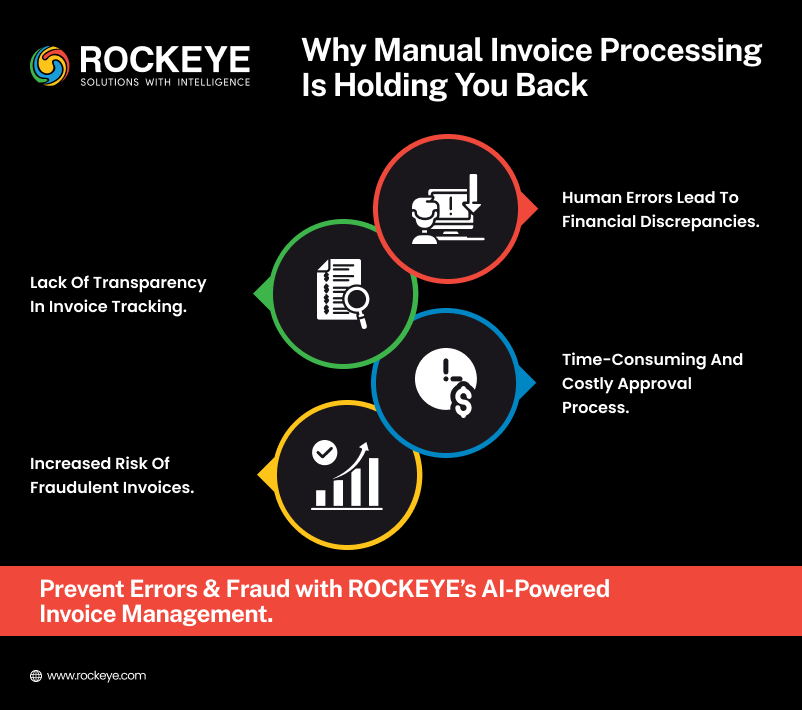

Disadvantages of Not Having an Automated Approval Workflow

An automated workflow ensures quicker turn around times and lower chances of errors. If you rely completely on manual processes, your workflow will have unavoidable gaps and delays.

For companies that are just starting, manual approvals might seem practical. But in the long run, this becomes tedious, time-consuming, and erroneous, with the number of invoices increasing rapidly.

Here are some challenges of not having an automated approval process.

Manual Mistakes

To error is human. Thereby, manual processes are bound to have a margin of error. You may end up overpaying or underpaying your vendors, or missing important payment due dates. This can lead to financial discrepancies and complications in the business.

Slower and More Expensive Process

If each invoice is processed manually, it will take a longer time to complete. This will directly lead to more expenses, in terms of man-hours and productivity. A delay in payment cycles may also affect professional relationships and put too much pressure on your employees.

Lack of Transparency

Digitizing all invoices leads to more transparency than a manual approval process. Its absence may lead to a lack of information for payment recipients, confusion regarding purchase details, and an overall lack of transparency in the process.

Higher Fraud Risks

In the absence of an automated workflow, it becomes easier to create fraudulent bills and hoodwink the accounts department. Manual invoices are more vulnerable to tampers and can create major financial problems for the company.

Choosing an Efficient Automated Solution

Choosing the right e-procurement solution is very important for your company. You need a platform that can generate, send, and receive POs as well as invoices. This solution has to be integrated with all departments to unify the whole organization’s procurement workflow.

An automated approval workflow eliminates manual processes, streamlines the purchase process, verifies associated details, and clears invoices in record time. You can control the whole process, starting from receiving the invoice to paying the vendor.

A supply chain ERP handles invoice approvals efficiently by reducing or eliminating paperwork, replacing manual entries, omitting errors, accelerating the process, and increasing straight-through processing.

Conclusion

Every business needs a suitable invoice approval workflow to accommodate its requirements. You can choose an ideal solution based on the amount of work and your budget. At the end of the day, all efficient automated solutions seek to reduce labor and increase productivity in your workflow.

FAQ

FAQ 1: What is an invoice approval workflow?

Answer :

An invoice approval process includes reviewing and approving invoices from suppliers or vendors before starting the payment process. This takes place after the buyer receives an invoice and is required to pay the stakeholder. The workflow involves a series of steps that need to be followed in order to clear the invoice and make the payment. You can include all steps into this workflow that ensure there are no overlooks, discrepancies, or errors.

FAQ 2: Why is it beneficial to automate the invoice approval workflow?

Answer :

Automation helps you in streamlining the approval process, building successful relationships with vendors or partners, and maintaining transparency in payment cycles. It also reduces the margin of error or discrepancies in the manual invoicing system. Nowadays, almost all organizations prefer to have a digitized invoice approval workflow to manage their payables.

FAQ 3: What are the main steps to create an invoice approval workflow?

Answer :

Firstly, you have to ensure all invoice details are captured correctly into the approval workflow. This includes details such as products, payable amount, vendor address and bank details, etc. Once all the details are entered into the workflow, the invoice has to be categorized and associated with all relevant data. If the invoice fails to show any supporting documents due to a discrepancy, missing PO, or other errors, they should be forwarded to an authorized individual for rechecks and validation. After validation, it must be sent to the approvers. Finally, once the approval process is complete, the invoice should be forwarded to the finance or accounts department for payment clearance.

Q 4: What are the benefits of having an automated approval workflow?

Answer : There are several benefits to having an automated invoice approval workflow. They are:

- Improved regulatory compliance

- More transparency in the process

- Reduced margin of errors and overlooks

- Streamlined process to reduce time and effort

- Increased efficiency and employee productivity

- Integration with existing company systems

- Lower processing costs for each invoice

Q 5: What happens if I rely on manual invoice processing instead of automation?

Answer : If you rely completely on manual processes, your workflow will have unavoidable gaps and delays. For companies that are just starting, manual approvals might seem practical. But in the long run, this becomes tedious, time-consuming, and erroneous, with the number of invoices increasing rapidly.