Knowing how purchase orders and invoices differ plays a key role in managing finances well. These documents are key tools in business deals, each with its own job. A purchase order kicks off the transaction, while an invoice is the seller’s bill. To get a good grasp on these two parts of finance, let’s look at what they mean how they’re alike how they differ, and why they matter in various business tasks. Let’s understand Purchase Order Vs Invoice.

What is a Purchase Order (PO)?

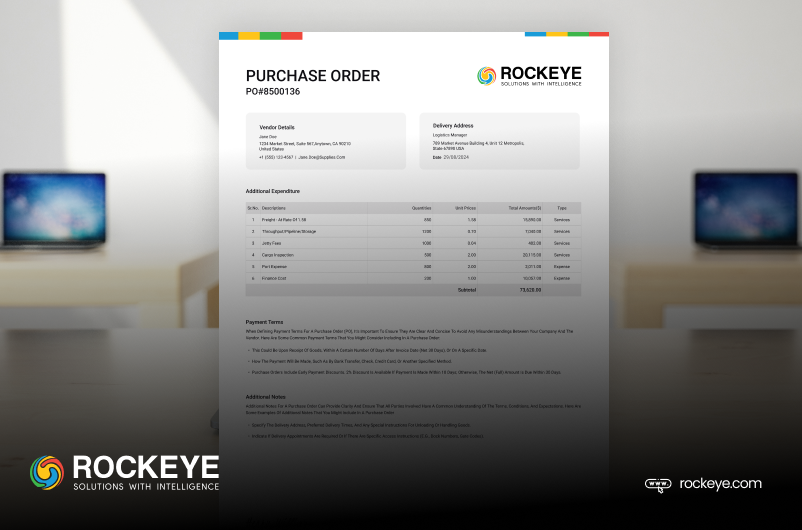

The buyer kicks off a business deal by sending a purchase order to a certified seller. This order asks for specific items based on the price list. Once approved, the purchase order becomes a binding contract. ROCKEYE’s procurement software module automates the whole PO process making sure everything is accurate and follows the rules at each stage. Here’s what you’ll see in a purchase order:

What is an Invoice?

The seller sends out a bill when they finish the job or business activity as agreed in the order form. This bill shows the final cost the buyer needs to pay once the order is done. Based on what was talked about in the order form, the bill might also say how the buyer plans to pay. It’s key to include the original order form with the bill for checking. Here’s what you’ll see in an invoice:

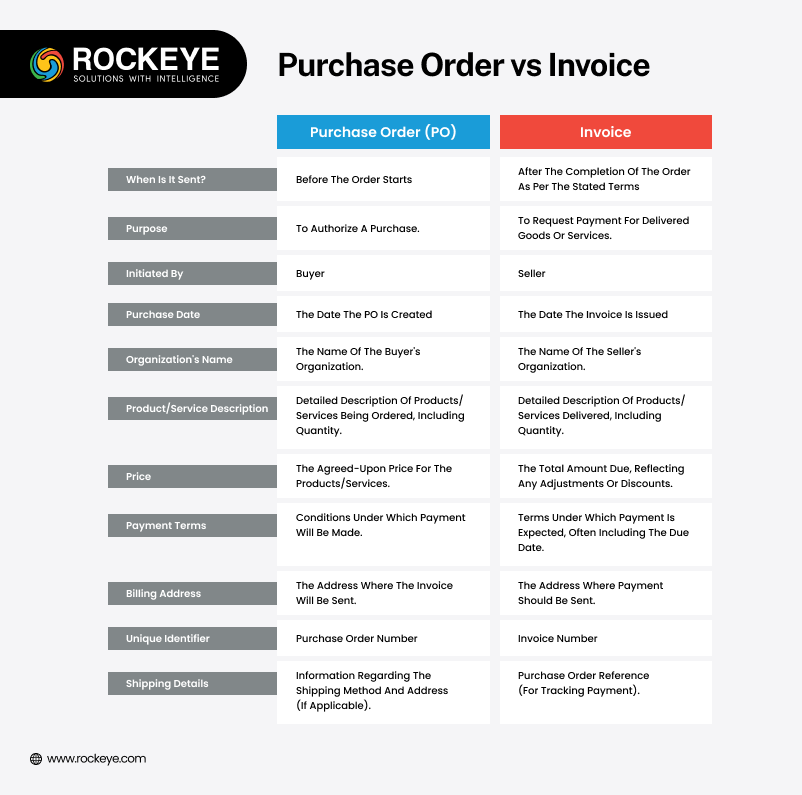

Purchase Order vs Invoice

The main difference between an order form and a bill is timing: you use an order form when you’re buying something, but you get a bill when it’s time to pay for what you bought.

Here’s a breakdown to compare the two documents:

Similarities Between PO and Invoice

Even though purchase orders and invoices serve varied purposes, there are a few points of similarity between them:

Firstly, these documents implicate legal contracts based on terms agreed upon by the buyer and seller. Both include details such as billing information, price, and the number of goods or services. Additionally, in the case of an invoice, vendor contract information, payment adjustments, invoice number, payment due on the seller, and payment due date are all specified.

Need for Both Purchase Order and Invoice

These two documents are the source of legally binding the buyer and seller according to the terms of payment. POs and invoices can be used by the company according to the situation, whether it needs to provide services or products and sometimes place an order too.

If the company primarily offers services and raises an invoice, there may come a time when a purchase needs to be initiated. This is where the purchase order helps the finance team in managing the expenses.

Also Read: ERP for Manufacturing : Boost Productivity & Profitability

Why Does the Company Use a Purchase Order?

Purchase orders play a significant role in every company, irrespective of its business size. Here are some of the reasons:

1. Expectations are set in advance

With the help of POs, buyers can state their requirements to sellers for sourcing. These purchase orders are referred to by both parties if the orders are not delivered as expected.

2. Managing orders becomes easier and better

POs serve as official documentation for the finance, operations, and procurement teams regarding upcoming or pending deliveries. This documentation helps track and manage orders more easily and effectively. Businesses are increasingly adopting AI-driven solutions to optimize logistics and streamline these processes. Learn about the transformation with AI in logistics and how it can enhance supply chain efficiency.

3. Cost overruns can be prevented

The purchase order helps clarify payment terms if the cost has increased by the supplier. The initial cost decided in the pricing agreement can be referred to using the Purchase Order.

4. Legal binding document

In case a contract has not been signed by the buyer and seller, the purchase order serves as a legally binding document. However, it becomes legally authorized only when it is approved by the vendor.

5. Performance issues can be detected

The assessment of purchase orders will help the company identify the orders that have contributed to its growth. Conversely, the orders that add cost without much value can be identified with the records of the Purchase Order.

Why Does a Company Use an Invoice?

The invoice validates the payment details documented legally in the absence of a contract. It creates a paper trail between the buyer and the seller. Suppliers, clients, and your company are all busy with daily tasks, so tracking payments may be overlooked. In such a scenario, the invoice becomes a practical way of highlighting the payment details and other information relevant to the client. Here are some other aspects of the invoice:

1. Vendors collect money

To initiate a business transaction, a phone call or email reminder is not sufficient. It is the invoice that is sent to the finance department for processing the payment.

2. Maintain transparency in cash flow

The company can keep a record of transactions with the help of invoices and know what other departments are purchasing. This, in turn, helps maintain transparency in the company’s cash flow.

3. Manage payments

Keeping track of payments becomes simplified with the help of invoices. The total amount paid to date, outstanding charges, and additional charges can be indicated through the invoice. This becomes challenging without a proper invoice.

4. Invoice speeds up payment and processing

Since all the payment details are included in the invoice, fewer questions will be asked by the client. Hence, the payment and its processing become easier with the help of invoices.

5. Brand identity is reinforced

If the company uses personalized invoices with the help of invoicing software or apps, there is a high likelihood of reinforcing brand identity. Whether it is the appearance of the invoice or its content, the customer’s perception of the company’s business will improve.

Also Read: Cloud Based HRMS Trends: Future-Proofing HR Management

Conclusion

The discussion of purchase orders vs. invoices is all about understanding these legal documents’ significant differences and similarities. They are beneficial for small businesses to maintain detailed sales records and purchases accurately in the financial statements. Paper-based or digital solutions for purchase orders and invoices can be used to keep the transaction details between buyer and seller transparent.

In modern times, digital invoices can be created through software, allowing these documents to be referred to anytime without hassle. Since not every business can afford to integrate technological solutions for purchase orders and invoices, traditional paper-based records should be maintained. Most importantly, the organization can validate payments easily if the documented purchases or sales are in front of the professionals in the financial department. Lastly, it can be summed up that companies should value purchase orders and invoices according to their utility in tracking purchases and sales done on behalf of the company.

For companies looking to automate these processes and improve operational efficiency, ROCKEYE’s Solutions offer cutting-edge tools that ensure accuracy, transparency, and streamlined financial management.